GSK delivers sales and earnings growth in Q2 2019

Issued: London, UK

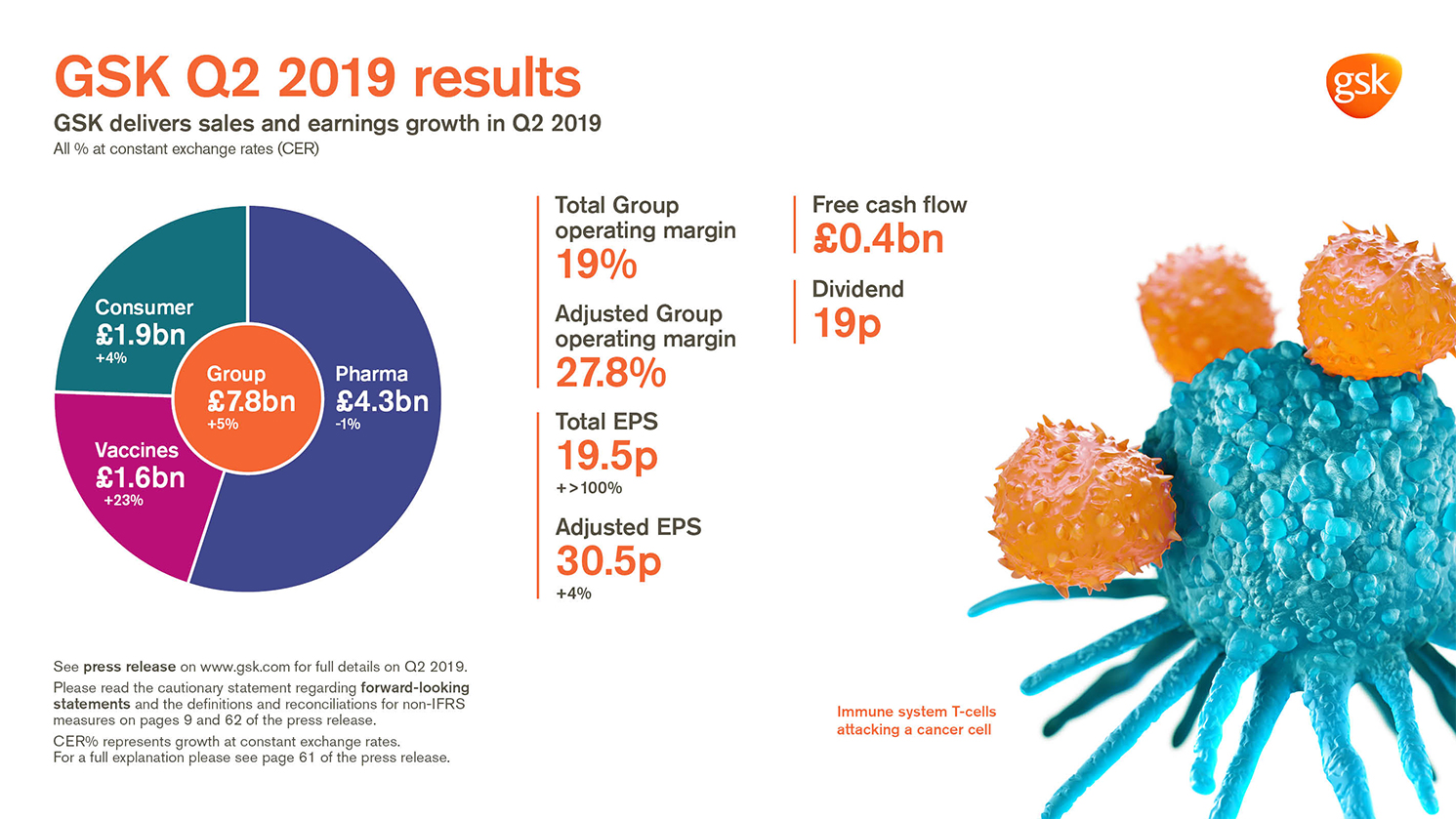

Total EPS 19.5p, +>100% AER, +>100% CER;

Adjusted EPS 30.5p +9% AER, +4% CER

Financial and product highlights

- Group sales £7.8 billion, +7% AER, +5% CER. Pharmaceuticals £4.3 billion, +2% AER, -1% CER;

Vaccines £1.6 billion, +26% AER, +23% CER; Consumer Healthcare £1.9 billion, +5% AER, +4% CER - Shingrix sales £386 million, driven by continued strong launch execution in the US

- Total Respiratory sales £752 million +16% AER, +12% CER. Trelegy Ellipta £120 million +>100% AER, +>100% CER,

Nucala £195 million, +38% AER, +33% CER - HIV sales £1.2 billion +2% AER, -2% CER. Tivicay and Triumeq sales £1 billion -3% AER, -6% CER. Juluca and Dovato sales £89 million

- Total Group operating margin 19.0%

- Adjusted Group operating margin 27.8%, down 1.0 percentage point AER, down 1.4 percentage points CER (Pharmaceuticals: 29.2%; Vaccines 38.6%; Consumer Healthcare 20.4%) with increased investment in R&D, up 20% AER, 16% CER

- Total EPS 19.5p, +>100% AER, +>100% CER reflecting lower charge for quarterly revaluation of HIV business and, following the buyout in Q2 2018, absence of Consumer Healthcare put option charge

- Adjusted EPS 30.5p +9% AER, +4% CER reflecting operating performance and settlement of open tax matters

- Q2 net cash flow from operations £1.4 billion. Free cash flow £0.4 billion

- 19p dividend declared for the quarter; continue to expect 80p for FY19

- 2019 Adjusted EPS guidance improved to expected decline of -3% to -5% at CER from -5% to -9%

Pipeline update and newsflow

- Oncology:

- Positive headline results from PRIMA trial for Zejula as 1L maintenance therapy for ovarian cancer regardless of biomarker status. Full results to be presented at an upcoming scientific conference

- sNDA accepted by FDA for Zejula for priority review in late stage ovarian cancer following QUADRA trial

- Bintrafusp alfa (M7824) alliance with Merck KGaA, Darmstadt, Germany progressed to pivotal phase III in biliary tract cancer

- Positive ICOS phase II data in solid tumours to be presented at an upcoming scientific conference

- HIV:

- Two-drug regimen Dovato (DTG+lamivudine) approved in Europe for treatment naïve HIV patients

- Positive 96-week follow-up data from GEMINI study of Dovato versus three-drug regimen and positive TANGO study demonstrating efficacy of switching treatment experienced patients to Dovato to be presented at IAS

- ATLAS study for eight-week dosing of cabotegravir + rilpivirine expected in Q3

- Respiratory:

- Nucala for severe asthma approved in US for new at-home self-administration option

- Positive results from pivotal CAPTAIN study for Trelegy Ellipta in asthma

- Vaccines:

- Shingrix approved in China for prevention of shingles in adults aged 50 and over

- Phase III start for otilimab (anti-GM-CSF) for rheumatoid arthritis

- For H2 2019, six potential major regulatory submissions: Zejula 1L ovarian cancer, belantamab mafodotin in multiple myeloma; dostarlimab in endometrial cancer; Trelegy Ellipta in asthma; fostemsavir in HIV; daprodustat for anaemia (Japan)

Emma Walmsley, Chief Executive Officer, GSK said:

“GSK delivered continued good operating performance in Q2 despite the loss of exclusivity of Advair. We are increasing our expectations for the year and have updated our guidance for 2019.

"We remain focused on strengthening our R&D pipeline and the execution of new product launches. Positive clinical data received so far this year offer significant new opportunities for products in Oncology, HIV and Respiratory and we expect more important readouts in the second half of the year. We also expect to complete our joint venture with Pfizer shortly, laying the foundation for the creation of two great companies: one in Pharmaceuticals/Vaccines; one in Consumer Healthcare.”

Watch Emma Walmsley, CEO, summarise our performance at Q2 2019.

Watch Hal Barron, Chief Scientific Officer and President, R&D, give an update on R&D.

Watch a 60 second summary of our performance at Q2 2019.

About GSK

GSK – one of the world’s leading research-based pharmaceutical and healthcare companies – is committed to improving the quality of human life by enabling people to do more, feel better and live longer. For further information please visit https://www.gsk.com/en-gb/about-us/

Assumptions and cautionary statement regarding forward-looking statements

The Group’s management believes that the assumptions outlined above are reasonable, and that the aspirational targets described in this report are achievable based on those assumptions. However, given the longer term nature of these expectations and targets, they are subject to greater uncertainty, including potential material impacts if the above assumptions are not realised, and other material impacts related to foreign exchange fluctuations, macro-economic activity, changes in regulation, government actions or intellectual property protection, actions by our competitors, and other risks inherent to the industries in which we operate.

This webpage contains statements that are, or may be deemed to be, “forward-looking statements”. Forward-looking statements give the Group’s current expectations or forecasts of future events. An investor can identify these statements by the fact that they do not relate strictly to historical or current facts.

They use words such as ‘anticipate’, ‘estimate’, ‘expect’, ‘intend’, ‘will’, ‘project’, ‘plan’, ‘believe’, ‘target’ and other words and terms of similar meaning in connection with any discussion of future operating or financial performance. In particular, these include statements relating to future actions, prospective products or product approvals, future performance or results of current and anticipated products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, dividend payments and financial results.

Other than in accordance with its legal or regulatory obligations (including under the Market Abuse Regulation, the UK Listing Rules and the Disclosure and Transparency Rules of the Financial Conduct Authority), the Group undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

The reader should, however, consult any additional disclosures that the Group may make in any documents which it publishes and/or files with the SEC. All readers, wherever located, should take note of these disclosures. Accordingly, no assurance can be given that any particular expectation will be met and investors are cautioned not to place undue reliance on the forward-looking statements.

Forward-looking statements are subject to assumptions, inherent risks and uncertainties, many of which relate to factors that are beyond the Group’s control or precise estimate. The Group cautions investors that a number of important factors, including those on this webpage, could cause actual results to differ materially from those expressed or implied in any forward-looking statement. Such factors include, but are not limited to, those discussed under Item 3.D ‘Risk Factors’ in the Group’s Annual Report on Form 20-F for 2018. Any forward looking statements made by or on behalf of the Group speak only as of the date they are made and are based upon the knowledge and information available to the Directors on the date of this report.