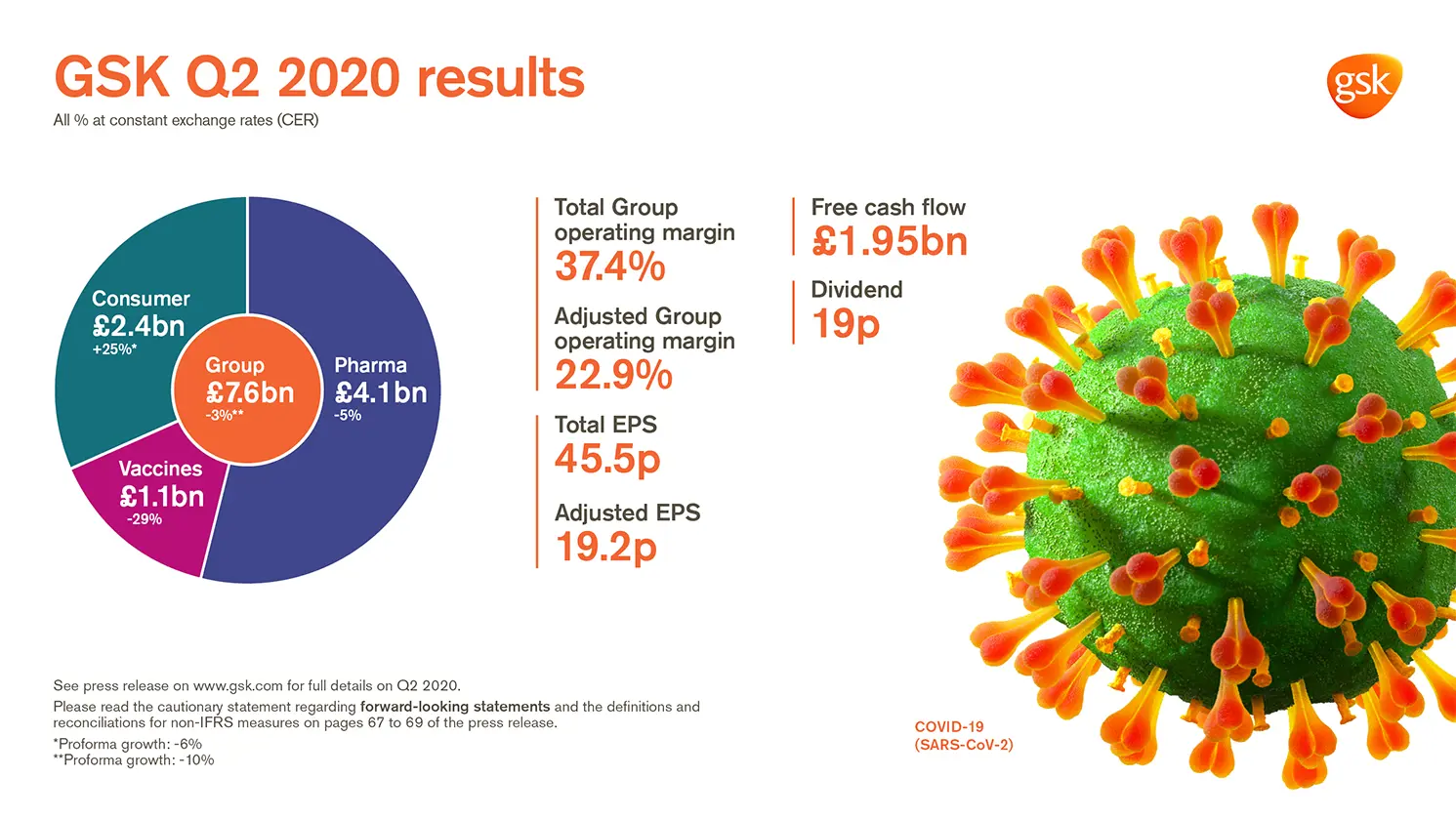

GSK delivers Q2 sales of £7.6 billion -2% AER, -3% CER (Pro-forma -10% CER*)

Issued: London, UK

Total EPS 45.5p >100% AER; >100% CER; Adjusted EPS 19.2p -37% AER, -38% CER

Financial and product highlights

- Reported Group sales £7.6 billion -2% AER, -3% CER (Pro-forma -10% CER*; -8% CER excluding divestments/brands under review). Pharmaceuticals £4.1 billion -5% AER, -5% CER; Vaccines £1.1 billion -29% AER, -29% CER; Consumer Healthcare £2.4 billion +25% AER, +25% CER (Pro-forma -6% CER)

- H1 Reported group sales £16.7 billion 8% AER, 8% CER (Pro-forma flat CER*; +1% CER excluding divestments/brands under review)

- Sales decline in Q2 2020 reflects expected disruption from COVID-19, particularly in Vaccines as well as destocking from Q1 2020 in Pharmaceuticals and Consumer Healthcare

- Total Respiratory sales £883 million +17% AER, +16% CER. Trelegy sales £194 million +62% AER, +58% CER. Nucala sales £241 million +24% AER, +21% CER

- Total HIV sales £1.2 billion, -2% AER, -3% CER. Dolutegravir sales £1.1 billion, -1% AER, -2% CER, two-drug regimen sales £181 million, >100% AER, >100% CER (Dovato sales £68 million, >100% AER, >100% CER, Juluca sales £113 million, +35% AER, +33% CER)

- Shingrix sales £323 million, -16% AER%, -19% CER

- Total Group operating margin 37.4%. Adjusted Group operating margin 22.9%, reflecting lower sales and growth in investment in R&D

- Total EPS 45.5p; >100% AER, >100% CER reflecting profit on disposal of Horlicks and other Consumer Healthcare brands

- Adjusted EPS 19.2p -37% AER, -38% CER reflecting lower sales and higher non-controlling interests following creation of the Consumer Healthcare JV in 2019 and a higher tax rate

- Q2 net cash flow from operations £2.76 billion. Free cash flow £1.95 billion

- 19p dividend declared for the quarter

Guidance

- Guidance for 2020 Adjusted EPS maintained; outcome is dependent in particular on timing of a recovery in vaccination rates

Pipeline highlights

-

Continued strengthening of the biopharma pipeline which now contains 35 medicines and 15 vaccines; over 75% of pipeline assets are focused on immunology

-

Three approvals in Q2: Zejula in ovarian cancer, Rukobia in HIV, Duvroq in anaemia (Japan). Expect further approval decisions for assets in Oncology and Respiratory

-

HIV

-

Cabenuva resubmitted in the US as HIV treatment; regulatory decision anticipated Q1 2021

-

Data showing superiority of long-acting cabotegravir versus Truvada in PrEP presented at IAS

-

FDA approval of Rukobia as first-in-class treatment for adults with few treatment options available

-

-

Oncology

-

Zejula approved by FDA for first line maintenance treatment in ovarian cancer in all comers regardless of biomarker status

-

Positive European CHMP opinion for belantamab mafodotin in multiple myeloma; FDA AdCom voted in favour (12-0) of risk-benefit profile with approval decision anticipated in August

-

-

Respiratory

-

Nucala granted priority review by FDA for hypereosinophilic syndrome (HES). Decision expected H1 2021

-

-

Vaccines

-

New positive Phase II data received for RSV vaccine for maternal and older adults. Data to be presented at upcoming scientific congress. Phase III study start in maternal adults planned for H2 2020

-

Strategic collaboration announced with CureVac on mRNA technology

-

GSK’s response to COVID-19

- Multiple collaborations underway to develop adjuvanted COVID-19 vaccines. Phase I studies initiated by Clover Pharmaceuticals and Medicago

- Announced the intention to make 1 billion doses of vaccine adjuvant available in 2021. Agreement reached with UK Government to supply up to 60 million doses of candidate Sanofi-GSK vaccine. Discussions underway with US and EU

- Phase II/III study start expected in Q3 for Vir antibody for high-risk outpatients with COVID-19. Phase IIa POC study of otilimab as potential treatment for COVID-19 started

Emma Walmsley, Chief Executive Officer, GSK said:

"The fundamentals of GSK’s business remain strong and we are maintaining good momentum on our strategic priorities. This quarter, we presented promising data and had positive regulatory reviews for new speciality pipeline medicines to treat HIV and Oncology; and made further progress with our Consumer Healthcare integration and Future Ready programmes, both of which will prepare the company for separation.

“We continue to believe that multiple options will be needed to prevent and treat COVID-19 and are working at pace with our partners to develop potential adjuvanted vaccines and therapeutics to fight the virus. At the same time, we have made strategic investments in next-generation vaccine and antibody technologies, most recently through our new collaboration with CureVac.

“As expected, our performance this quarter was disrupted by COVID-19, particularly in our Vaccines business, as visits to healthcare professionals were limited due to lockdown measures. Overall, we are seeing good underlying demand for our major products and are confident this will be reflected in future performance when the impact of COVID measures eases.”

About GSK

GSK – one of the world’s leading research-based pharmaceutical and healthcare companies – is committed to improving the quality of human life by enabling people to do more, feel better and live longer. For further information please visit www.gsk.com/about-us

Assumptions and cautionary statement regarding forward-looking statements

The Group’s management believes that the assumptions outline in the 2019 Annual Report and relevant quarterly results announcements are reasonable, and that the aspirational targets described in such report or announcement are achievable based on those assumptions are reasonable, and that the aspirational targets described in such report or announcements are achievable based on those assumptions.

However, given the longer term nature of these expectations and targets, they are subject to greater uncertainty, including potential material impacts if the above assumptions are not realised, and other material impacts related to foreign exchange fluctuations, macro-economic activity, the impact of outbreaks, epidemics or pandemics, such as the COVID-19 pandemic and ongoing challenges and uncertainties posed by the COVID-19 pandemic for businesses and governments around the world, changes in regulation, government actions or intellectual property protection, actions by our competitors, and other risks inherent to the industries in which we operate.

The Group’s reports filed with or furnished to the US Securities and Exchange Commission (SEC) and any other written information released, or oral statements made, to the public in the future by or on behalf of the Group, may contain forward-looking statements. Forward-looking statements give the Group’s current expectations or forecasts of future events. An investor can identify these statements by the fact that they do not relate strictly to historical or current facts.

They use words such as ‘anticipate’, ‘estimate’, ‘expect’, ‘intend’, ‘will’, ‘project’, ‘plan’, ‘believe’, ‘target’ and other words and terms of similar meaning in connection with any discussion of future operating or financial performance. In particular, these include statements relating to future actions, prospective products or product approvals, future performance or results of current and anticipated products, sales efforts, expenses, the outcome of contingencies such as legal proceedings, dividend payments and financial results. Other than in accordance with its legal or regulatory obligations (including under the Market Abuse Regulation, the UK Listing Rules and the Disclosure and Transparency Rules of the Financial Conduct Authority), the Group undertakes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

The reader should, however, consult any additional disclosures that the Group may make in any documents which it publishes and/or files with the SEC. All readers, wherever located, should take note of these disclosures. Accordingly, no assurance can be given that any particular expectation will be met and shareholders are cautioned not to place undue reliance on the forward-looking statements

Forward-looking statements are subject to assumptions, inherent risks and uncertainties, many of which relate to factors that are beyond the Group’s control or precise estimate. The Group cautions investors that a number of important factors, including those in this document, could cause actual results to differ materially from those expressed or implied in any forward-looking statement.

Such factors include, but are not limited to, those discussed under Item 3.D ‘Risk Factors’ in the Group’s Annual Report on Form 20-F for 2019 and any impacts of the COVID-19 pandemic. Any forward-looking statements made by or on behalf of the Group speak only as of the date they are made and are based upon the knowledge and information available to the Directors on the date of the relevant report or announcement.

A number of adjusted measures are used to report the performance of our business, which are non-IFRS measures. These measures are defined and reconciliations to the nearest IFRS measure are available in our 2019 Annual Report and in the relevant quarterly results announcement.

The information in this website does not constitute an offer to sell or an invitation to buy shares in GlaxoSmithKline plc or an invitation or inducement to engage in any other investment activities. Past performance cannot be relied upon as a guide to future performance. Nothing in this website should be construed as a profit forecast.