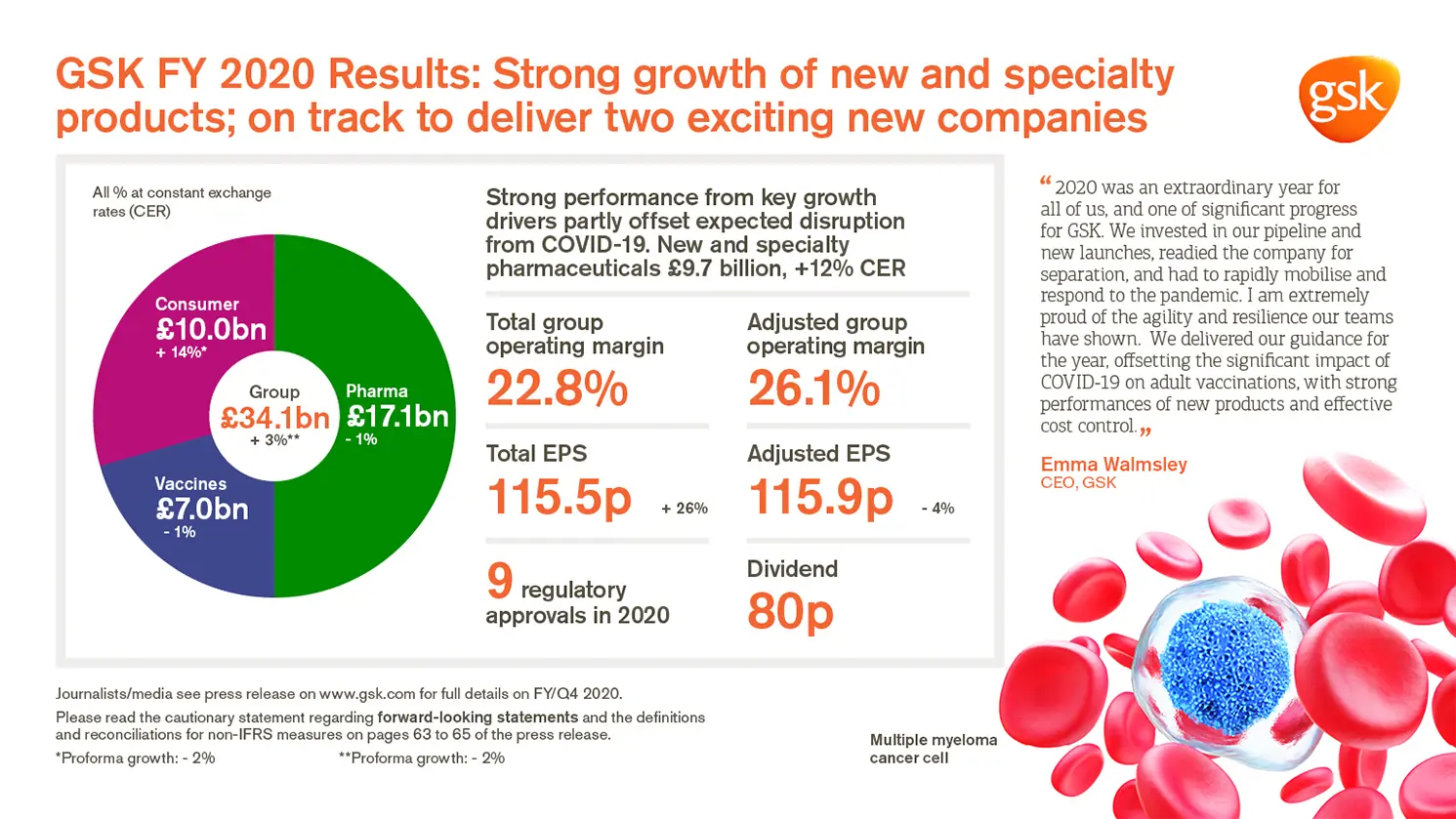

GSK delivers FY 2020 reported sales of £34 billion, +1% AER, +3% CER and Adjusted EPS of 115.9p, -6% AER, -4% CER, in line with guidance; Total EPS 115.5p, +23% AER

Issued: London, UK

Strong growth of new and specialty products; on track to deliver two exciting new companies

Full results announcement (PDF)

Download the FY 2020 results announcement

Highlights

Strong sales performance from key growth drivers in HIV, Respiratory, Oncology and Consumer Healthcare offset disruption from COVID-19 to adult vaccinations

- Pharmaceuticals £17 billion -3% AER, -1% CER; new and specialty products £9.7 billion +11% AER, +12% CER

- Vaccines £7 billion -2% AER, -1% CER. Shingrix £2 billion +10% AER, +11% CER

- Consumer Healthcare £10 billion +12% AER, +14% CER (pro-forma -2% CER*)

- New Biopharma product portfolio strengthened with 9 approvals in 2020 and Cabenuva in the US in January 2021

Effective cost control supports delivery of adjusted earnings per share in line with FY 2020 guidance

- Total Group operating margin 22.8%. Total EPS 115.5p +23% AER, +26% CER

- Adjusted Group operating margin 26.1%. Adjusted EPS 115.9p -6% AER, -4% CER

- Q4 net cash flow from operations £4 billion. Free cash flow £3 billion

Significant progress on Biopharma pipeline with over 20 assets now in late-stage clinical trials

- 20+ new product launches planned by 2026, 10+ with potential peak annual revenues in excess of $1 billion

- Pivotal study starts/data expected in 2021 for RSV vaccine in older adults, COVID-19 assets, long-acting anti IL-5 antagonist, daprodustat and dostarlimab

- Oncology momentum building: 15 potential medicines in trials, including 9 immuno-oncology and 3 cell therapies

- 20+ deals executed, including acquisitions of new antibody, mRNA and genetics/genomics technologies

On track for separation into new standalone Biopharma and Consumer Healthcare companies in 2022

- 2020 targets met with £0.3 billion annual cost savings and £1.1 billion divestment proceeds achieved

- Biopharma investor update in June to set out progress on innovation, commercial execution and growth outlook together with capital allocation priorities

Sustained progress and leadership in ESG

- Sector leading in key indices, including DJSI and Sustainalytics, and #1 rank in 2021 Access to Medicines Index

- New environmental targets set to achieve net zero impact on climate and net positive impact on nature by 2030

2021 Adjusted EPS expected to decline by a mid to high-single digit percentage in CER

- Reflects further growth in new and specialty products and Consumer Healthcare, increased investment in our pipeline and deferral of strong growth in Vaccines performance due to impact of COVID-19 immunisation programmes

- 2022 outlook remains unchanged. Continue to expect meaningful improvement in revenues and margins

Dividend of 23p/share declared for Q4 2020; 80p/share for FY 2020. Expected dividend of 80p/share for FY 2021

- Distribution policy for new GSK to be implemented in 2022 to support growth and investment. Aggregate distributions expected to be lower than at present

Emma Walmsley, Chief Executive Officer, GSK said:

“2020 was an extraordinary year for all of us, and one of significant progress for GSK. We invested in our pipeline and new launches, readied the company for separation, and had to rapidly mobilise and respond to the pandemic. I am extremely proud of the agility and resilience our teams have shown. We delivered our guidance for the year, offsetting the significant impact of COVID-19 on adult vaccinations, with strong performances of new products and effective cost control.

“Importantly, progress against our strategic goals remains firmly on track. We are building a high value biopharma pipeline, have substantially integrated our Consumer JV and have delivered all our first year targets for our two year separation programme. This means we are in a strong position to launch new competitive, standalone Biopharma and Consumer healthcare companies in 2022. In doing so, we have high confidence that we can achieve meaningful global impact to health and significant value creation for shareholders.”

About GSK

GSK is a science-led global healthcare company with a special purpose: to help people do more, feel better, live longer. For further information please visit www.gsk.com/about-us.

Assumptions and cautionary statement regarding forward-looking statements

The pro-forma growth rates at CER in this Results Announcement have been provided to illustrate the position in 2020 relative to the position in 2019 as if, for the purposes of the 2020 results, the acquisition of the Pfizer consumer healthcare business had taken place as at 31 July 2018 and that, accordingly, seven months of results of the former Pfizer consumer healthcare business were included in the year ended 31 December 2019. The results of the former Pfizer consumer healthcare business included for the year ended 31 December 2019 are as consolidated (in US$) and included in Pfizer’s US GAAP results. The results for the year ended 31 December 2020 used to calculate the pro-forma growth rates are as reported at CER.

The pro-forma growth rates have been provided for illustrative purposes only and, by their nature, address a hypothetical situation and therefore do not represent the Group’s actual growth rates. The pro-forma growth rates do not purport to represent what the Group’s results of operations actually would have been if the Pfizer acquisition had been completed on the date indicated, nor do they purport to represent the results of operations at any future date. In addition, the pro-forma growth rates do not reflect the effect of anticipated synergies and efficiencies or accounting and reporting differences associated with the acquisition of the Pfizer consumer healthcare business.